🤘🏻 DeF*-ing the system 🤘🏻

We need your support to keep growing 🙏🏻 – know someone who would like to read these weekly updates? Forward this email to them or click the button below!

To Operators,

Ever try to send a wire? An international wire? Get a loan? Exchange an asset for another?

It’s hell. Not only does it take days or weeks, you also wind up paying tons in fees.

Why is this the case? It’s because the legacy banking system is outdated, broken, and greedy.

The financial plumbing we know today was built in a pre-internet world where institutions had a monopoly on money moving technology. They retained this monopoly through the dawn of the internet and have somehow remained relevant. In addition to using technology inferior to modern solutions, they have also gotten away with charging massive fees for sub-optimal service.

What if you didn’t need Wells Fargo to send money to Europe? Or need to call a loan officer at Bank of America to get a loan?

Good news: you don’t.

Cryptocurrencies and blockchain technology are already solving these issues. The banks are walking zombies and they don’t even know it.

The legacy system

Modern banks and financial services companies are centralized. To use their services you need to go to a central place, accept their rules, and ultimately be approved by them to participate.

Let’s look at the process to trade securities in the US…

To open an account at TD Ameritrade, you need to provide a valid US bank account, proof of identification, your social security number, and often some kind of proof of funds or income verification.

Once this is complete, you wait a few days and see if you get approved. If you’re lucky enough to get approved you then need to wait several more days to wire or ACH money to the brokerage and enter trades (hope it’s not on a weekend!).

This is the bare minimum needed to be able to invest in the US, but what if…

You don’t have a bank account

You don’t have identification

You’re not a US citizen (or even live in the US)

You have non-standard income

You have low or zero credit

Then you’re probably going to get denied and won’t have access to one of the best wealth building tools that exists.

Building a better way

The legacy system is a rigged game. Why play it?

Enter decentralized finance or DeFi. OK cool, but what is DeFi?

DeFi is peer-to-peer finance conducted on a blockchain using the set of rules defined transparently on the blockchain

DeFi is the same as regular finance, but instead of clearing through a centralized intermediary (think Bank of America or TD Ameritrade), transactions clear peer-to-peer transparently on the blockchain.

Transacting on a centralized exchange looks like this:

Buyers and sellers “get in the box” by jumping through the hoops created by the exchange. They then conduct their buying and selling and move funds outside of the “box”. The exchange regulates all of this activity and takes a fee for its services. At no point are you allowed to see exactly what’s going on in the “box”.

Transacting on a decentralized exchange looks like this:

Buyers and sellers connect to the network by linking their crypto wallets. They then conduct their buying and selling with other peers on the network. When they are finished, they disconnect from the network and take their funds. The rules of the blockchain regulate the activity and the network operators take a fee for their services. Note there’s no “box” – at all points in time you are able to see exactly was is going on in the network.

What’s the big deal?

DeFi is a 10x improvement over the legacy system because it reduces friction and is open to all.

These two attributes work hand in hand to win business and increase addressable market for financial transactions. In developed markets, where financial participants have a lot of choice, they will (if they’re what economists call rational) choose the option that has the least friction.

For services like exchanges and lending, the winner is almost always DeFi, as legacy institutions are tied up regulatory constraints – ask your local bank to give you a loan on your bitcoin and you’ll probably get laughed out.

In under or undeveloped markets, people have the opportunity to become financial participants. 1.7B people in the world remain unbanked – but many have access to mobile phones and thus crypto. Crypto is their gateway to the monetary system and DeFi is their link to financial services.

With DeFi, the un and underbanked suddenly get access to one of the greatest tools used in growing economic activity: leverage. With the ability to borrow and lend these participants can grow their businesses exponentially and in turn grow their economies.

Tl;dr

DeFi is one of the most exciting use cases for crypto to appear. It is also one of the only use cases generating meaningful revenue via fees. However, it is still very early for DeFi – the current use cases are mostly focused on trading and leveraging digital assets. These are useful tools for crypto users but largely not super useful for the broader world… yet.

As the technology matures, UI/UX improves, and these networks get more stable, I’m excited to see what broader applications come to DeFi. This technology is extremely interesting because it has the ability to eat high-finance’s lunch but also provide a meaningful service to people in the world largely left behind by economic progress.

This candle burns at both ends.

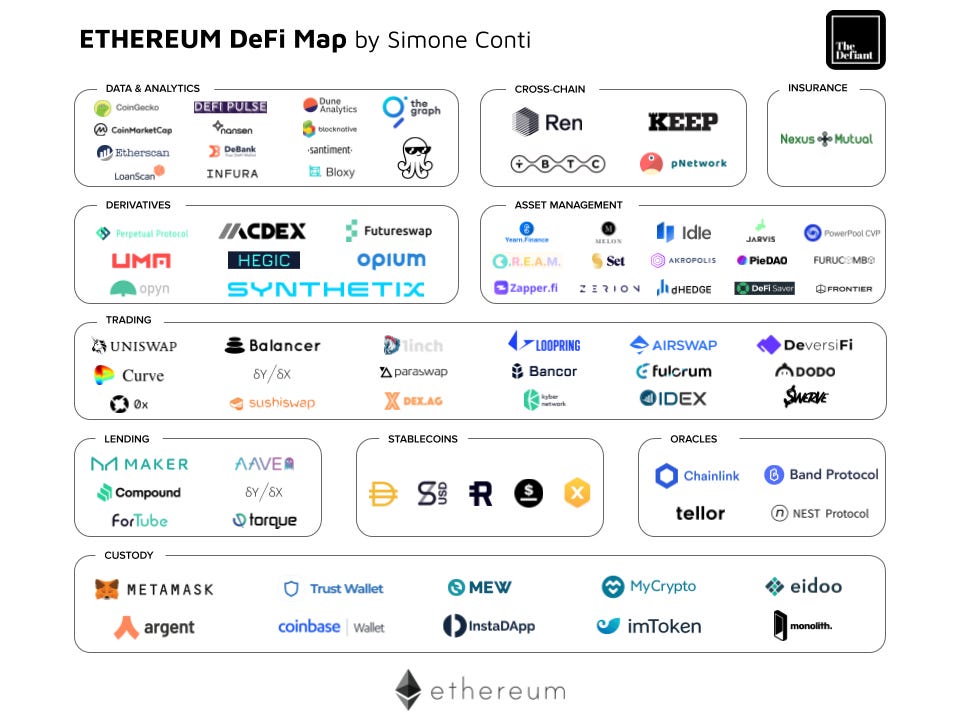

Some projects to check out…

Forward and upward.

The Portfolio Rundown

Not a ton of movement in the portfolio this week as net across the board things remain similar.

Bitcoin has resumed it’s run towards all time highs briefly breaking $60k before coming back down:

The orange coin still remains in bull-mode and I expect we’re starting our next leg up towards $100k. The trend put in after the Jan/Feb pullback looks like it’s going strong. If the price were to dive below $51k expect a retest of recent support around $45k.

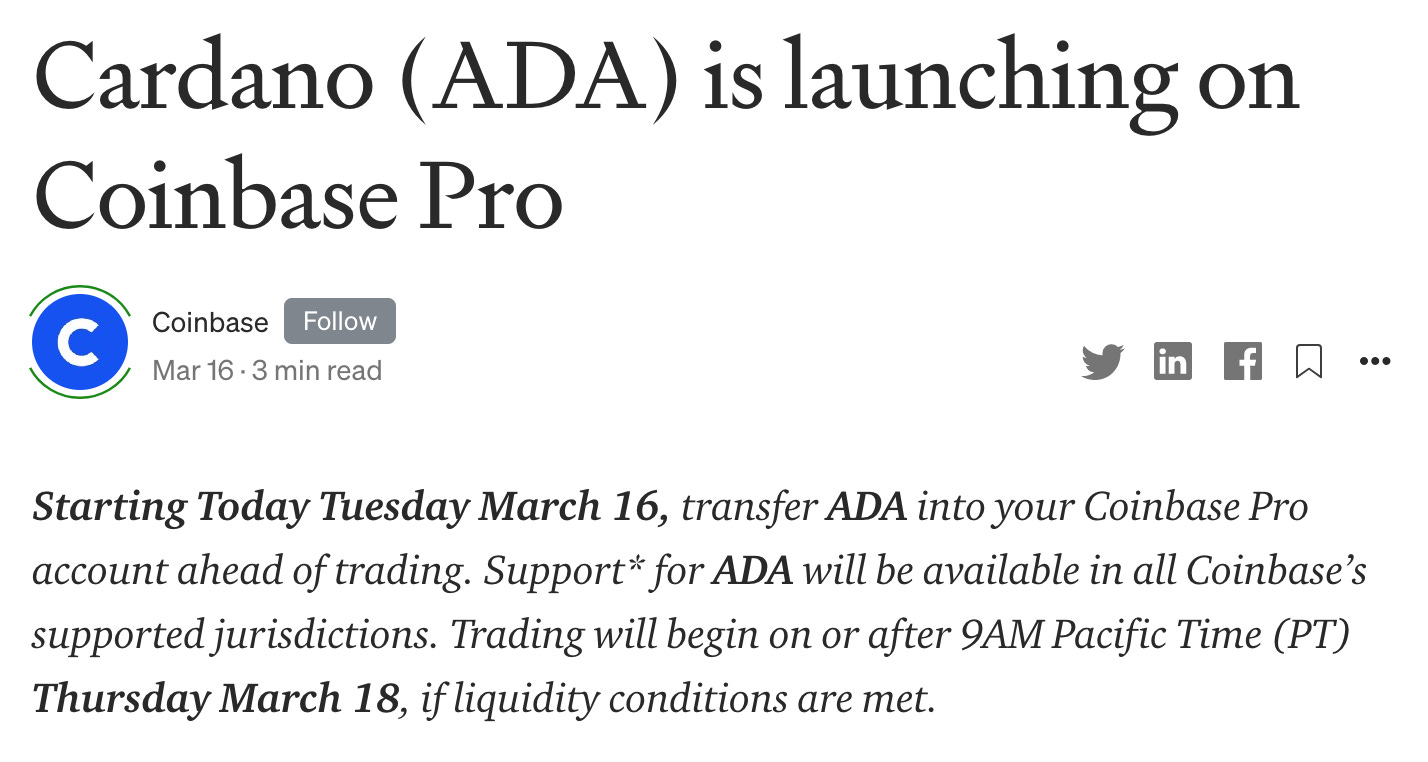

Cardano continues its hero story climbing rapidly on news of being listed on Coinbase Pro…

This is huge for $ADA as it has traditionally been relegated to 2nd tier US and international exchanges. The coin was also listed in Bloomberg’s network. It’s currently blowing off some steam but that’s to be expected given the recent run. I’m less concerned with day-to-day price action here and mostly focused on the rollout of Goguen (smart contracts) – should this fail or get delayed we’ll likely see a large downward movement in Cardano.

The Bancor position is doing well adding 20% since it was added a few weeks ago. I am continually blown away by the yield coming in from the liquidity pools. I am starting to look at staking more of my ERC-20 assets as this experiment plays out.

In the near term the ability to juice returns via yield is great and in the long term it has incredible potential to provide cashflow on a larger asset base.

The exit strategy for crypto isn’t to sell back into fiat folks ;)

✅ Thanks for reading Bitcoin Operator! Please ask your friends, billionaires, liquidity providers, and Technokings to sign up.

Get $10 FREE automatically deposited to your account when you trade $100 worth of crypto at Gemini | Sign up today using this link HERE

Nothing in this email is intended to serve as financial advice. Do your own research.