Hi Operators 👋,

Welcome to the +156 subscribers 💥 who have joined this week. If you’re reading this but haven’t subscribed, join our community of smart, fun & edgy crypto investors 👇

Would you take an annualized return of 20% at near-zero risk?

What a stupid question, who wouldn’t take that deal.

Well good news, you can, and it’s all because of contango, and no not the dance.

What is contango? 👓

Contango is a situation where the futures price of a commodity is higher than the spot price. Contango usually occurs when an asset price is expected to rise over time.

-Investopedia

Bitcoin trades like a commodity (think corn or gold) and exchanges have created derivatives (futures contracts) so traders can hedge or speculate on future prices.

Futures contracts are commonplace in all commodities markets.

A contango situation arises when buyers are paying a premium over the spot price for future exposure to a commodity.

Put simply, buyers are paying more for future Bitcoin vs. the market price today.

This product of supply and demand eventually terminates in a convergence between spot and futures prices, but until that happens an arbitrage opportunity exists.

“Free” money is the best money 📈

Currently, Bitcoin is in a contango situation.

Annualized premiums on futures contracts are as high as 20% and recently have been as high as 30%.

The contango exists because of how profitable it is to leverage long Bitcoin – related is the amount of capital going long vs. short.

Currently there is about $19B in open interest on Bitcoin futures contracts which means this market is sizable and liquid.

There’s different flavors and premiums depending on what contracts you’re trading (perpetual vs. long forward) but the mechanics are the same: leveraged longs are paying a premium to leveraged shorts for their exposure.

Put simply, contract buyers are paying up to contract sellers.

Arbitrage ain’t dead yet ⚰

If you’ve read this far an idea has probably popped into your head…

Why don’t I buy Bitcoin at the market and sell futures contracts, pocketing the spread?

Look at you a 21st century arbitrageur – but never to be as cool as the Druckenmiller’s and Boesky’s of the 80s.

The answer is that you can, and this trade still has a lot of gas left in the tank.

The contango arbitrage trade is simple:

Find a futures provider you want to use (list above) and find out the quantity of bitcoin in the contract

Go to any exchange and buy that quantity of bitcoin

Go to your chosen provider and sell a futures contract (again flavors vary here - DYOR)

Pocket the premium

It’s a near-zero risk trade because it is net-zero in terms of long/short exposure.

If the contract size is 10 BTC you are long 10 BTC via the buy and short 10 BTC via the futures contract.

When delivery comes you simply deliver the 10 BTC and walk away.

The only risk carried by the trader is custody risk – just don’t lose your keys.

Your reward for the trade? An easy 20% annualized return courtesy of the longs.

Tl;dr

👉 There’s so much money chasing leverage long bitcoin positions it pays to be short

👉 You can harvest premiums while remaining market neutral by buying BTC at the spot and selling futures contracts – this is an arbitrage trade

👉 It’s a near zero-risk trade – just don’t lose that private key

👉 The contango can and will break when more capital goes leverage short vs. leverage long – this is called backwardation

👉 Backwardation probably won’t happen until old hodl’ers start dumping in size

Forward and upward.

The Weekly Fund Rundown

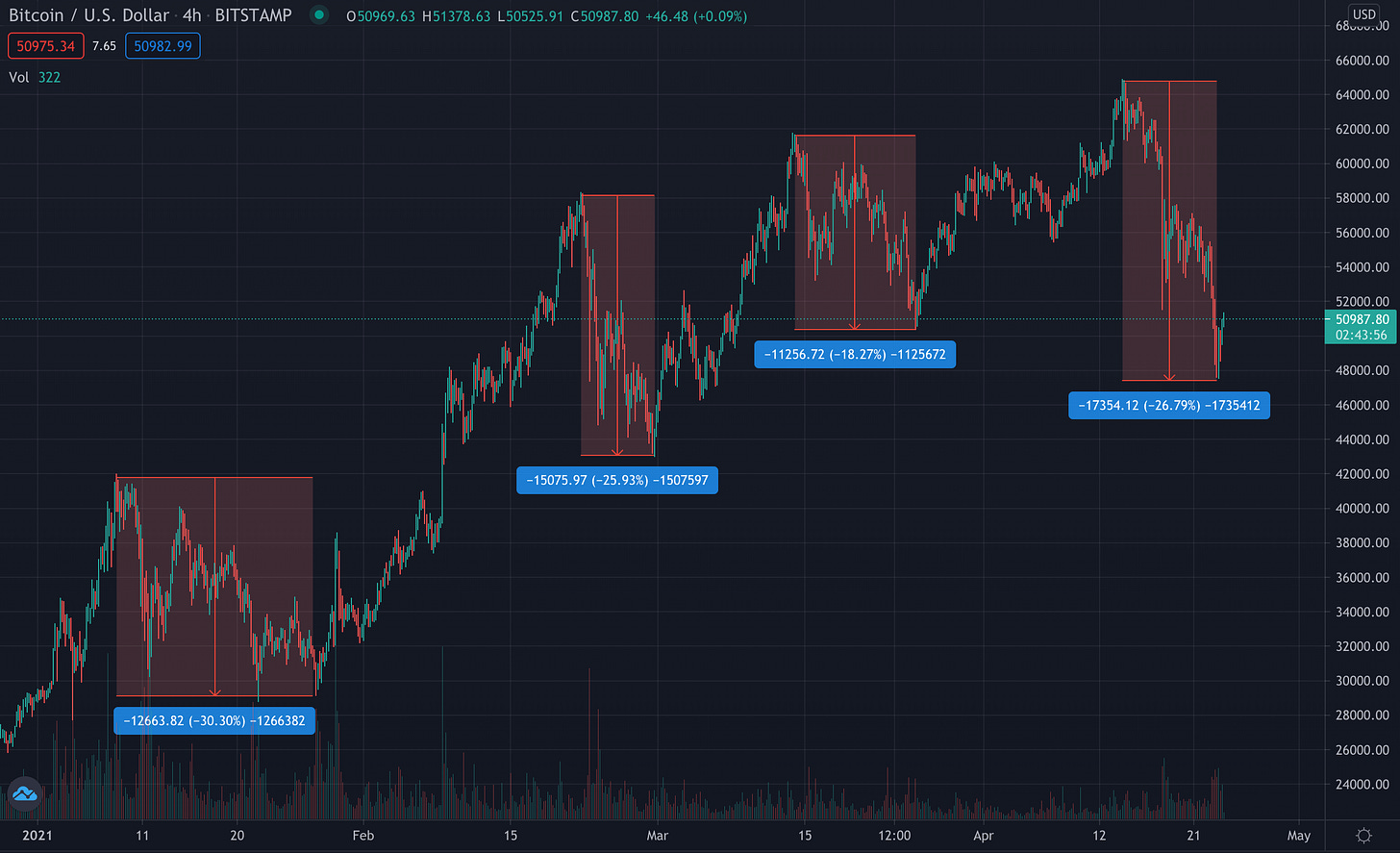

Blood on the streets (again) as the crypto market continues its 4th dip of 2021. Bitcoin is down 27% from it’s all time high so far…

This dip is cutting deep but so far has not been as bad as the one we saw in early January. Bitcoin found support at the $1T market cap level but that has since been broken, I’m expecting the orange coin to put in a deeper low before it turns upward again.

This represents a great time to #BTFD. I’ve topped up the PNK position to just over 1% of the portfolio and have also added to AAVE and LINK.

ADA is on an aggressive downtrend and I expect it to dip below $1 again soon, depending on the magnitude of the drop here I’m definitely looking to add to this position as well.

Don’t sleep on a sale.

Yield-land

New segment of the rundown to give you an update on staking activities and spot yield

ADA position is 100% delegated earning ~5% annually

ETH position is 75% staked in Bancor liquidity pools earning ~7% annualized

BNT position is 100% staked in Bancor liquidity pools earning ~40% annualized

✅ Thanks for reading Bitcoin Operator! Please ask your dance teacher, friend that bought Dogecoin, and your neighbor to sign up.

Get $10 FREE automatically deposited to your account when you trade $100 worth of crypto at Gemini | Sign up today using this link HERE

Nothing in this email is intended to serve as financial advice. Do your own research.

Want more? Follow us on Twitter 🐦